offshore bank

- Christian Reevesa

- Categories: Blockchain, International Bank License, Offshore Bank License

In this post, I’ll look at the recent failures in

- Christian Reevesa

- Categories: Business Planning, Puerto Rico

Establishing a bank in any part of the world requires

- Christian Reevesa

- Categories: International Bank License, Puerto Rico

Puerto Rico serves as a hub for various financial institutions,

- Christian Reevesa

- Categories: Business Planning, International Bank License, Offshore Bank License, Puerto Rico

In this post, I’ll consider the risks of buying an

- Christian Reevesa

- Categories: International Bank License, Offshore Bank License, Puerto Rico

In this post, I will compare and contrast US banking

- Christian Reevesa

- Categories: Business Plan, Business Planning, International Bank License, Offshore Bank License, Puerto Rico

In this post, I will look at the proposed changes

- Christian Reevesa

- Categories: Bank Holding Company, Bermuda, Business Plan, Business Planning, International Bank License, Offshore Bank License

I expect Bermuda to become the next great international banking

- Christian Reevesa

- Categories: Sin categoría

In this article, we’ll look at how to set up

- Christian Reevesa

- Categories: Offshore Bank License, Puerto Rico, United States, US Bank License

A very rare opportunity is available in the US territory

- Christian Reevesa

- Categories: Business Plan, Business Planning, Offshore Bank License

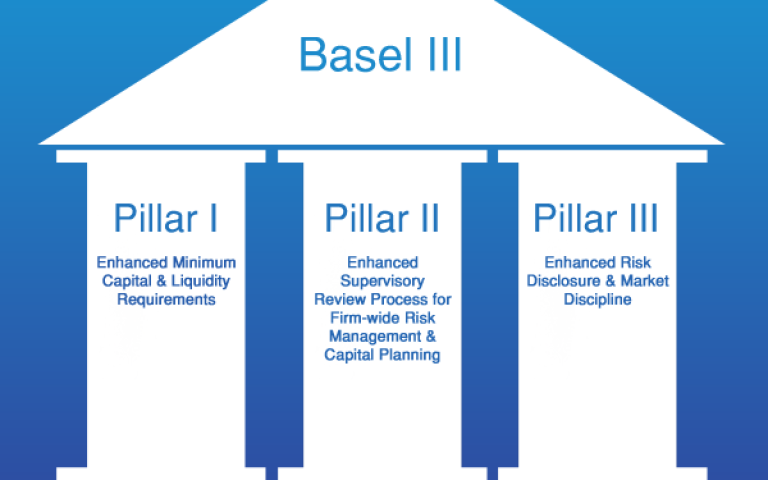

Basel III is a regulatory framework that includes a number

Categories

Categories

- Bank Holding Company

- Bermuda

- Blockchain

- Business Plan

- Business Planning

- BVI

- Cayman Islands

- Development

- Dominica

- Financial Services Company

- Fintech

- Hong Kong

- International Bank License

- Investment

- Longer Reads

- Luxembourg

- Mexico

- Offshore Bank License

- Offshore Banking

- Panama

- Puerto Rico

- Puerto Rico Bank License

- Remittance

- Sin categoría

- SOFOM

- Software

- St. Lucia

- Swift Code

- Swiss

- Swiss trust company

- Switzerland

- UK

- Uncategorized

- United States

- US Bank License