Financial technology (FinTech) and digital assets have transformed the global financial landscape. From e-wallets and payment processors to cryptocurrency exchanges and blockchain platforms, new players are disrupting how money moves, how investments are managed, and how individuals interact with financial services. Yet behind this innovation lies a critical foundation: banking. Without licensed banking institutions to provide custody, settlement, and regulatory legitimacy, the FinTech and digital asset revolution cannot function. Increasingly, entrepreneurs are turning to international bank licenses to build compliant, scalable platforms that connect digital innovation to the traditional financial system.

Why FinTech and Digital Assets Need International Banks

FinTech firms and digital asset companies face a paradox. They are at the cutting edge of innovation, but they must also meet the stringent requirements of global regulators and payment networks. International banks play a vital role by providing:

- Custody of Funds – Licensed banks can safeguard client deposits, fiat reserves for stablecoins, and collateral for lending platforms.

- Payment Infrastructure – Access to SWIFT, Fedwire, and correspondent banking is often only possible through a licensed bank.

- Regulatory Compliance – Banks bring credibility, AML/KYC frameworks, and structured oversight to digital asset operations.

- Capital and Liquidity – Banking licenses allow FinTechs to offer lending, credit, and yield products with proper regulatory approvals.

Offshore Banking Licenses as a Gateway

Offshore banking jurisdictions have become central to the growth of FinTech and digital assets. By obtaining international banking licenses, firms gain the ability to operate cross-border, serve global clients, and manage assets in multiple currencies. Benefits include:

- Regulatory Agility – Offshore licenses often have lighter regulatory burdens, enabling faster product launches.

- Global Client Access – Firms can onboard international users without being restricted to a single domestic market.

- Tax Efficiency – Many jurisdictions offer low fixed tax rates or exemptions for foreign-sourced income.

- Privacy with Compliance – Offshore banks can provide confidentiality while still meeting international AML standards.

Case Uses in FinTech and Digital Assets

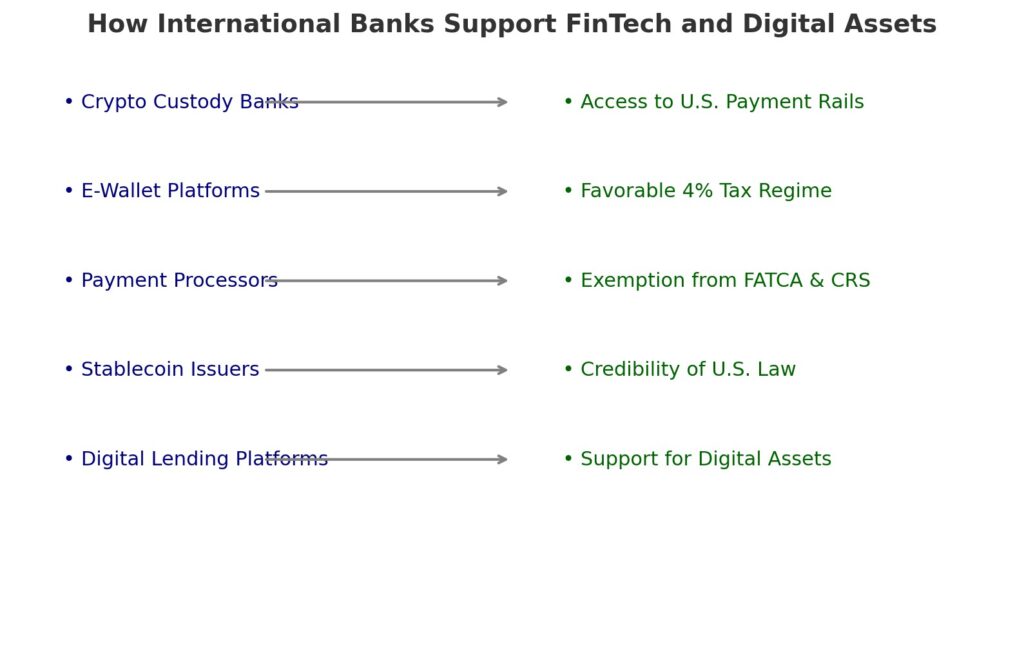

The intersection of international banking licenses and FinTech is visible in several business models:

- Crypto Custody Banks – Licensed banks that specialize in safeguarding digital assets alongside fiat reserves.

- E-Wallet Platforms – Offshore banks power global digital wallets by holding user deposits and processing payments.

- Payment Processors – Cross-border merchants rely on banks with international licenses for settlement and clearing.

- Stablecoin Issuers – Licensed banks hold the fiat collateral backing stablecoins, ensuring regulatory acceptance.

- Digital Lending Platforms – Offshore banks provide credit facilities that support peer-to-peer and institutional lending markets.

Puerto Rico’s Unique Role in FinTech Banking

Puerto Rico has emerged as a premier jurisdiction for FinTech and digital asset firms due to its International Financial Entity (IFE) license under Act 273. The IFE structure provides a U.S.-regulated banking platform with key advantages:

- Access to U.S. Payment Rails – IFEs can connect to U.S. correspondent banks, Fedwire, and SWIFT.

- Favorable Tax Regime – A fixed 4% corporate tax rate and exemptions on dividend distributions to foreign shareholders.

- Exemption from FATCA and CRS – Reducing compliance costs for international operations.

- Credibility of U.S. Law – Unlike traditional offshore centers, IFEs operate under U.S. federal legal standards, increasing trust with partners.

- Support for Digital Assets – OCIF permits IFEs to act as digital asset custodians, subject to regulatory approval.

Challenges and Considerations

While offshore banking licenses offer significant advantages to FinTech and digital asset firms, challenges remain. Compliance obligations are high, and regulators are increasingly cautious about the risks posed by cryptocurrencies and decentralized finance. Entrepreneurs must be prepared for rigorous due diligence, capital requirements, and scrutiny of their business models. Moreover, jurisdictions vary widely in credibility—choosing the wrong one can result in correspondent banking challenges or reputational risks.

Conclusion

International banks have become the backbone of FinTech and digital asset innovation. By securing offshore banking licenses, crypto firms, e-wallets, and payment processors gain access to global markets, regulatory legitimacy, and financial infrastructure. Among the available jurisdictions, Puerto Rico stands out as the ideal choice for entrepreneurs seeking both offshore flexibility and U.S. regulatory credibility. In 2025 and beyond, the synergy between international banking and digital finance will only deepen, shaping the future of money and global commerce.